Blog of a Freelancer – January 23rd, 2018 Freelance Money: In & Out

Keeping a close eye on the money in and money out of your freelance business is very important. A freelancer will have irregular income. You always need to know:

- Are you doing well?

- Who’s paid, who hasn’t?

- What do you owe the tax man?

I use an Excel doc to track all my invoices, totals and debts. It’s just one sheet that I update every few days - it’s the most important business file I have.

Are you doing well?

How much money do you need to make to keep going as a freelancer? It could be what you want, but you have to know what you need. It’s the income you need to be able to pay your bills (including business costs), live and eat. Work it out as a monthly amount.

Let’s say you’ve figured out you need $1,000 in your hand each week = $4,000 each month.

Now add any tax payments on top of that to get your gross income amount. Say you’re likely to pay around 30% of your income to the tax man (don’t forget any GST requirements if you need to). That means around 70% of each invoice total is yours. Work it out: 4,000 / 0.7 = 5,714.

So you will need to clear $5,714 at least each month, after any expenses or costs of sales.

You will need to meet or exceed that total each month to keep the business going. Make sure the invoice total you are tracking here does not include costs or expenses - only the taxable amount.

I have changed my target amount a few times over the years, as the business and life expenses changed. Keep an eye on your success target - it needs to be real. It defines your financial success and underpins your longevity.

Pay a wage

It’s good practice to pay yourself a regular, weekly wage. Is it that $1,000 you need? Then that’s what you draw out of the business account each week. Keep any extra for when times are tough. Once you have a decent buffer, reward yourself for that good work!

Who’s paid and who hasn’t

I use the same spreadsheet to track all my invoices. I clearly mark off overdue and paid invoices every week or two. You might use a service to generate invoices - awesome.

I check the business bank account every few days and make notes of any recently paid invoices in the spreadsheet. This way I’m able to take a quick glance and know what’s paid and what isn’t.

At the start of each month I will do all my invoices for the previous month (there’s a lot of maintenance work). I will also send reminders for any outstanding invoices - with the original invoice re-attached. Overdue invoices can be expected, unpaid not so much. Luckily I’ve only had two or three invoices in 10 years that remain forever unpaid - instances where the client collapsed before payment (and thankfully smaller amounts).

Set aside time to do all your invoices for the week or month (weekly is too often for me). Do it with regularity.

How I track my invoices

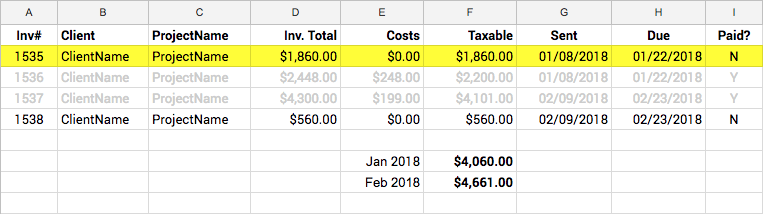

Overdue are marked yellow (I need to watch these) and paid are greyed out (no need to worry about these). The only total I care about is the taxable income of each invoice.

An example of the columns I use, and some demo content:

Then just keep adding invoices, keep adding months, keep adding years. It will allow you to easily see your progress and performance over time. You can add a bunch of filters, formulas and graphs to this data: giving you a detailed picture of your business.

What do you owe the tax man?

There should be few surprises when it comes time to pay your tax obligations.

Each week I look at what invoices have been payed into the business bank account. I then transfer 40% of this total into my hands-off tax account. I do this week in, week out.

This guarantees that every three months, I have the money to pay my tax bill. I know I can’t touch this money - it’s not mine (oh but the temptations!). There is a buffer there - it’s more than I need to set aside (always something for the one-person office xmas party).

Money in, Money out, One sheet

I’ve used one simple spreadsheet to track all my invoices and all my monthly totals since the business began. I can tell immediately if things are going well, or need some work.

Use the energy you get from being payed to power the discipline you need to keep track of the cash.

After doing good work - it’s what will keep your business going.

And finally… I have a professional bookkeeper to look over my books every three months and submit them to the taxation department. Then once a year - a tax accountant to review and submit my yearly statement. Their advice and accuracy pay for themselves.

------

I've been a freelance interface designer, UX / UI guy and front-end developer for over 22 years, and a full-time freelancer since 2006. Contact me if you're looking for a help with your project, or your freelance setup.

Quick facts

- Freelance web designer based in the Blue Mountains (just outside Sydney)

- Prefer to work from my office

- Hour rate: $ contact me

- Project rate: $ will quote

- I'm passionate about quality

- Married, with two great kids

Skill & software overview

- Trained graphic designer

- 22+ yrs commercial experience

- User-centred approach

- Advanced Photoshop & Illustrator

- Advanced HTML & CSS

- W3C & WAI compliant

- Responsive / Mobile friendly

- WordPress customisation

- ExpressionEngine customisation

- Craft CMS customisation

- ZenDesk theme customisation

Right now I am...

- Working with Signet to lift their online presence. Interface design & code, EdMs and digital graphics are all part of the suite of changes underway.

- Ongoing work with Insignia to create digital art for online and tradeshow promotion.

- Working with a podcast production company on a popular US-based medical podcast website running Wordpress.

Testimonials

What an absolute superstar! Quite often we work with developers that are very slow on the uptake, thanks so much for completing these tasks so quickly.Eli, Castleford

Perfect... the sticky nav scroll etc looks great!Victor, Fox Symes & Associates

This is perfect, well done. For future reference things like this is why we like working with you, so keep it up.Rickard, Corality

Perfect thanks... Nice work.Vincent S, Fox Symes & Associates

Looks great! You’ve captured our intent really well... That looks amazing!... To me, it looks like you’re going in the right direction.Tom M, EPES Consulting

I love it man - You never disappoint, I'll pass on to the guys and come back to you... they all love it.Richard M, Marketing Consultant

This is perfect thank you, great job as always.Eric, NRL

I found Dave Rayner to be excellent. Fast, efficient and relatively cheap for website changes.Peter R, Balmain Sailing Club